2023: The First Half

IPv4 Markets and Pricing Observations and Thoughts.

by Lee Howard & Peter Tobey

Broad Pricing Trends

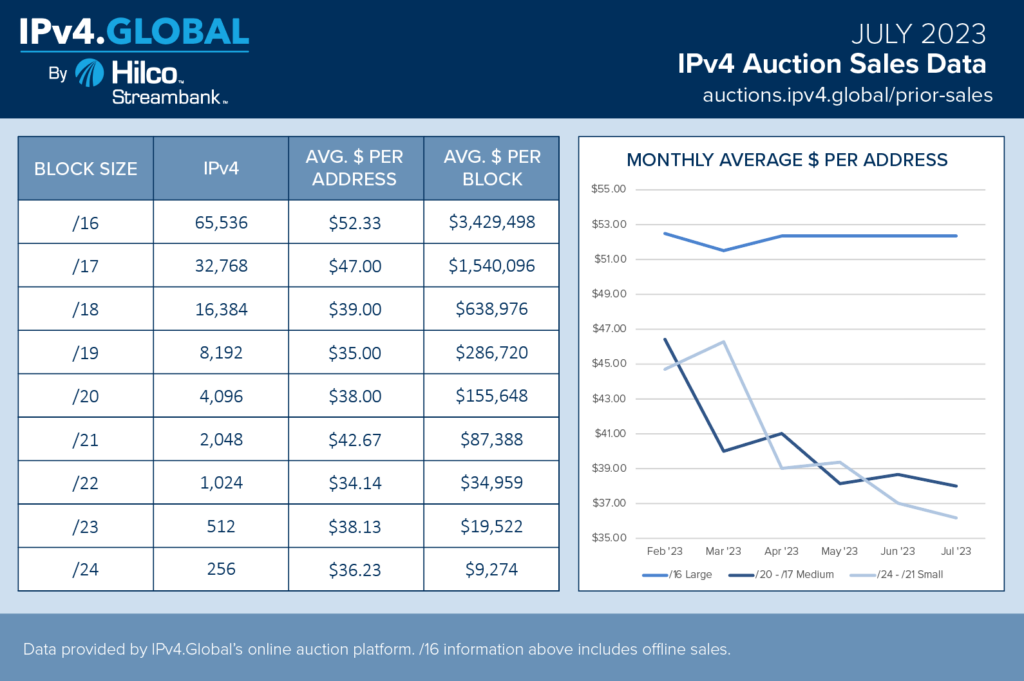

Previously, we’ve described the inversion of large block and small block address pricing. By the end of 2022, the divergence had been going on for 18 months and increased until there was a 20% premium on /16s and larger.

In the first six months of 2023, that trend has continued, with larger block prices hovering between $50-55 per address and smaller blocks continuing to fall in price. The difference in recent months has grown to 30-35%, with some small blocks dramatically less expensive than they have been since early 2021.

However, the very tight trading range for IP addresses in general that existed from early 2016 – when IPv4.Global’s auction site began publishing trade data – until mid-2021, has disappeared. Large blocks trade in a tight range. Smaller blocks have traded in a wider range of prices. Small block prices moved in a haphazard – if downward – fashion from mid-2021 through Q1, 2023.

Demand for /16s has kept prices even, perhaps marginally higher. Demand for /20 – /17 blocks is up slightly, enough to find a price equilibrium. The volume of small blocks available is high and prices have continued to slip.

Large blocks (/16 and larger) have remained costly. Smaller blocks have fallen in price but seem to be consolidating around more narrow bands.

Why?

Speculating on broad marketplace causes and effects is best introduced with caveats galore. Too often, correlation is mistaken for cause in any financial analysis.

The following are influences we see as likely impacting the market. To what extent each does so, we are uncertain.

Price/Demand Relationship

Many shrewd observers of the IPv4 market will opine that demand for this crucial element of network expansion varies independently of price for the addresses. That is: folks who need addresses buy them. The overall need for addresses is immediate and outweighs variation in price. Relatively small price variations don’t dampen need in this theoretical scenario.

Of course, this does not always prevail. Those with multi-year expansions often have fixed maximums on their spending plans and will often bargain shop.

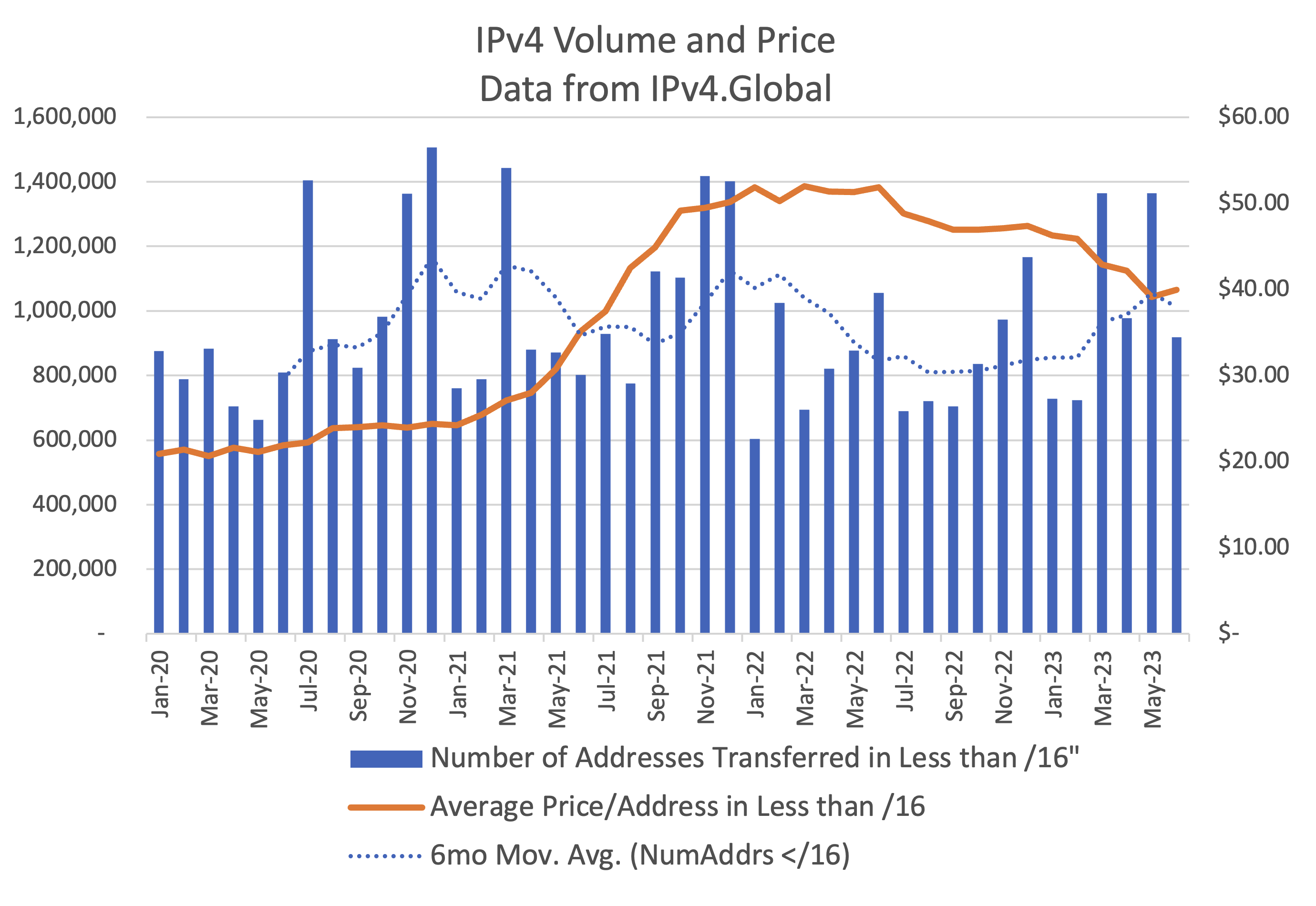

However, supply may very well influence pricing. And pricing impacts supply. It is simply true that the increase in IPv4 prices that followed rising demand in late 2020 and early 2021 encouraged the expansion of market supply. Rising prices surely prompted some additional sales. But that price increase was followed by falling demand during most of 2022. (Higher prices often dampen demand, even when the commodity is essential.) Unquestionably, that reduced demand has resulted in falling prices.

This chart shows lower volume (in blue) through 2022, perhaps resulting in falling prices. Note the earlly 2023 increase in volume and prices.

Reduced Demand

During much of 2022 (and most dramatically during mid-year) blocks smaller than /16s experienced a decline in demand – and a natural trough in transfers resulted. As demand softened, prices at first stabilized and then declined. This end to rising prices and the long, slow trend of falling values began in October 2021 and has continued until today.

It is important to note that prices continued to rise for a time (Q4 2021) even as demand softened. Such lags in supply/demand relationships are not unusual. It is possible that future demand increases will be followed by price increases only after some similar delay in market reaction. Reporting is also a factor: Price changes are a leading indicator. Note that the price date is the date a sale is agreed upon and the volume date is the date the transfer is complete, which is often weeks or even months later.

Beginning in March, 2023 activity in these smaller block sizes increased. This trend is too recent and short-lived to draw sound conclusions from it. However, in connection with some possible stabilizing of small-block prices, one might speculate that rising small block demand, and therefore the prices of them, may continue.

Causes

Start-up Blocks @ RIPE

From 2014 until 2019, it was very easy to get multiple blocks of 1,024 IPv4 addresses – a /22 –free from RIPE NCC. Each member could have multiple accounts, called LIRs (Local Internet Registry), and get a /22 for each one. This policy was intended to make sure new networks were still able to get some IPv4 addresses, even as the RIPE NCC was running out. It was about $10/address in 2014 but over $20/address in 2019.

The impact was substantial. RIPE NCC LIR numbers more than doubled from 10,000 members to 25,000. About 20,000 /22s were distributed.

From https://www.ripe.net/analyse/statistics/number-of-lirs

To make this even more attractive, from 2013 the RIPE NCC had a low, flat fee per LIR. While the precise numbers vary each year, the sign-up fee and annual flat fee has been about €1,500-1,750. This means that LIRs were paying about $7/address, which they could sell on the market for a considerable mark-up after holding them for just two years.

RIPE NCC distributed its last /22 in November 2019.

Some believe that the RIPE NCC’s supply-side management impacted market pricing. Two years after the last /22 was allocated the price peaked at over $60/address. The RIPE NCC’s membership rolls are declining, too. Membership numbers have dropped by about 2,000 members in the last two years.

It is possible that the large numbers of /22s that became available for resale around and after 2020 and 2021 has contributed to the steady decline in prices since. The leveling of prices in 2021 may well have spurred sales of these blocks, increasing supply and lowering prices.

Recession Fears

Beginning in March, 2022, the Federal Reserve began raising the federal funds rate, causing all other interest rates in the U.S. – and worldwide – to rise. At the same time the Fed forecast more rate increases and has fulfilled that promise by raising rates from 0.25% to the current 5.5%.

In anticipation of these rate increases most financial prognosticators (from bankers to media) anticipated much higher borrowing costs and, most likely, a recession varying from mild to not-so-mild. Without question, recession fears impacted long-term investment planning in some areas of the economy. It is reasonable to assume that network expansion plans, especially those not deemed essential or pressing, were delayed. Such a delay would reduce the demand for IPv4 addresses and therefore impact the marketplace cost of them.

Inconclusive Conclusion

The variables impacting prices are complex. Predicting future prices nearly impossible. The observations here suggest that small and medium-size block prices are stabilizing. If that were true it is anyone’s guess where they will venture going forward. So, the best course is to monitor sales and pricing going forward and be alert to opportunities. Under no circumstances would we predict that prices will remain the same as they are today.