IPv4 Address Assets

in Mergers & Acquisitions

by Peter Tobey

Merger and acquisition discovery processes vary in both design and execution. Often the transaction is focused primarily on key assets that are important to the acquiring entity. Frequently, other assets are earmarked for liquidation post-transaction. But a third category exists: the overlooked value buried – or otherwise unrecognized – in the sea of sometimes-visible, sometimes-hidden assets being considered.

Of course, the litany of under-exploited assets (or other value) in an acquisition is potentially very long. Here, one particularly common, liquid, and frequently overlooked asset is considered. IPv4 internet addresses are often found in older, often large but sometimes small entities. They are usually easy to make available for sale and their market is established. Best of all, common holdings of these addresses are worth seven and eight-figure prices.

What are IPv4 Addresses?

An IP (internet protocol) address is a numerical designation of a location on a network. The number identifies the location of a device that sends and/or receives data over that network.

It’s just a number. IPv4 addresses come from a range that starts at 0 and ends at 4,294,967,295. But they are written down in a “dotted decimal” format that looks like 203.0.113.79. Dotted decimal format makes it easier to know where ranges of these identifiers start and stop.

The address sited above (203.0.113.79) comes from a block of 256 addresses that have been set aside for use in documentation. Its full range is 203.0.113.0 – 203.0.113.255, which can also be written as 203.0.113.0/24. This is a small block of addresses, known as a “slash twenty-four.”

Who Owns These Numbers?

Numbers themselves cannot be owned. But an internet in which any network could use any address would not work. A sole entity has to possess and use the address. That’s because each location on a network has to be uniquely identified. Traffic could not get to the right destination if multiple devices and/or interconnected networks tried to use the same addresses. There are a number of ways to manage this matter of specific, unique locations for sending and receiving data. The means most important here is the unique IP address and its organized registration and use.

We don’t have the problem of disorganized communications arriving at inappropriate devices when relying on unique IP addresses because registries maintain the uniqueness of IP addresses across the internet. Registries (like phone books) keep track of who uses what numbers. Registries implement policies for maintaining those registrations. They support the transfer of IPv4 addresses through a secondary market and via mergers and acquisitions.

But what is being transferred or sold is not the underlying number. It is the registration rights to that number. This is analogous to registered intellectual property assets like patents, copyrights, and trademarks. They can all be sold or transferred between legal entities in a similar way to physical property.

There is pricing information on a per address basis published on the largest IPv4 marketplace: IPv4.Global. But – as you can see there – prices vary based on several factors including the size of the block and where it is registered. A bigger block (where all the numbers are sequential) is often more valuable as it reduces configuration complexity. Prices can be lower for blocks registered in LACNIC (serving Latin America and Caribbean regions) because its transfer process is slower.

Nonetheless, IPv4 address transfers regularly bring in more than $3 million from an asset that might not have been listed on any balance sheet.

Who are the Registries?

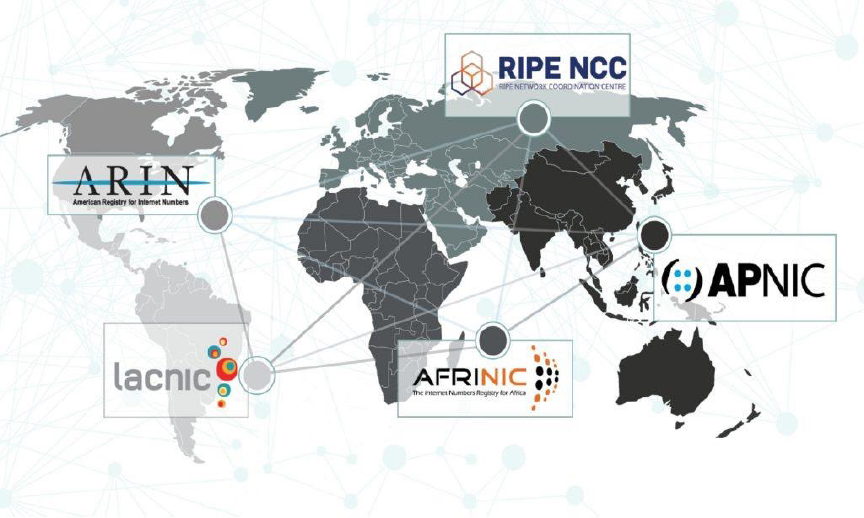

Five Regional Internet Registries (RIRs) manage data about IP addresses. They each serve a region of approximately continental scale. Network operators started creating RIRs in the early 1990s. Their primary purpose is to provide a more local service than the internet’s original central (worldwide) registry could provide.

They each provide public access to key registration data, including the registrant’s name and how to contact them. They also maintain non-public data about registrants, like payment history.

Map showing the five RIRs’ service regions, published under a CC-BY-A license by the Number Resource Organization

Each RIR is a legal entity bound by the laws of the country in which it is incorporated. This means they act on court orders and comply with sanctions and other regulations.

| RIR | Established in |

| AFRINIC | Mauritius |

| APNIC | Australia |

| ARIN | United States of America |

| LACNIC | Uruguay |

| RIPE NCC | Netherlands |

Chain of Custody

In the early days of the internet, computing was expensive and addresses were free. There was an apparent abundance of addresses (there are over 4 billion IPv4 addresses) and a limited number of networks that required them. As a result, addresses were “bundled” into only three distribution sizes:

- Class A networks were big – about 16 million IPv4 addresses

- Class B networks were medium-sized – about 65 thousand IPv4 addresses

- Class C networks were small – 256 addresses

Anyone needing more than a few Class Cs might be assigned a Class B. So, any organization that might need (or suspected they might eventually need) more than a thousand addresses would be given (free) 65 thousand of them. Some organizations received multiple Class B networks.

But companies, company divisions, and brands are bought and sold. So, the registries require that sellers demonstrate that they legitimately hold the rights to a registration – that is, own those rights – before transferring the registration from one user to another on their records. In some cases, this is easy. But in many corporate sales the list of assets purchased does not include the IPv4 addresses previously held by the acquired entity.

If the acquiring entity is unaware of the transferred asset whose ownership changed in the sale, the registration of the IP address will not be updated on the registry involved. Thus, the new owner of the addresses is not the registered user of them. Also, when an entity changes hands more than once these assets are even more likely to be hidden.

It is also important to note that an unreported transfer of addresses in a merger or acquisition is almost certain to be unknown to the registry that keeps track of these assets. Registries rely on reporting to know who has what. The don’t search. Very often IP address whereabouts become virtually unknowable by anything other than meticulous investigation. They may still be in use. They may have been legally transferred (knowingly or unknowingly) to a new entity. But their registration is inaccurate.

Due Diligence

The RIRs want to make sure they record the correct registrant for a block of IP addresses. So, when there are explicitly asked to register an ownership/use change, they do due diligence checks. For example, ARIN requires sellers to properly document change of ownership transactions. They can do this with:

- An asset purchase agreement or bill of sale

- Finalized merger, amalgamation agreement, or court order

- SEC documentation of asset transfer

- Documentation of name change, such as amended articles of incorporation

The use of “explicitly” above is meant to draw attention to the fact that a transferred registration only happens when the appropriate registry is asked to change its records. The practical ownership of the addresses may have changed with the transfer in a sale of “all other assets” but the official internet registry will have no way of knowing this has happened unless it is reported to them.

Looking at the real-world chain of custody of an IPv4 block of addresses might reveal a lack of updates to public RIR data. Before transferring any unused IPv4 addresses, you’ll need to update the registry with the identity of the proven owner of the asset.

This could mean changing the name of the registrant, the address of the headquarters, or contact information for the contacts.

Internal Audits

There are two important parts to effective valuation of IPv4 address holdings. The first is discovering who owns them. The second is determining if they are in use.

New networks tend to be managed through automation. Older networks were designed before automation was possible. In theory, documentation will report on holdings and their current use. But documentation does not always exist and where it does, individual configurations could well have been adjusted over the years. Often, a block of addresses that are idle become used, then re-assigned to a different use, all without records being adjusted.

Documenting the current state is the first step in adjusting it to a future desired state. Which is to say, an audit of holdings and current use will make an analysis of needs and sales opportunity possible. There are a number of ways in which addresses can be made available for sale, even if currently in use. A reliable IP address auditing tool, like ReView, can help with this. ReView can help organizations inventory what they have and understand how it is used, giving them the power to control changes.

Beyond verifying the accuracy of IP address records, ReView can help sellers strategically identify which IPv4 blocks to sell off to buyers and which to keep, considering the potential for future network expansion or long-term asset monetization.

RIR Transfer Requirements

Most organizations don’t struggle with these processes. There were over 5,800 recorded, non-M&A transfers worldwide in 2023 and almost 45,000 transactions since 2012.

While each RIR has different transfer requirements, the common elements are the same. These registries want to make sure the organization transferring the addresses is the organization that has legitimate control of the asset and so of the registration. They also need to comply with any sanctions or other restrictions.

The communities that develop RIR policies overlap considerably. For instance, people working at a network in North America might also operate in Europe. This has led to similar and interoperable policies in all five regions.

The RIRs want IP addresses to be used for networks and not as an investment asset. They require the buyer to demonstrate a need for the addresses. This means describing how the buyer will use the addresses over the next two years.

There are three exceptions worth noting:

- AFRINIC only supports transfers within its own region.

- LACNIC requires wet ink signatures on transfer documentation, slowing the process.

- RIPE NCC does not require a needs justification for transfers within its own region. It also supports temporary transfers, also known as leases.

Process Expectations

IPv4.Global can smooth your journey through the process because we’ve guided many buyers and sellers before. We actively work with all four transferring RIRs.

Whether transferring addresses within a region or to a buyer in another RIR, the process is similar. The process typically has five steps:

- Pre-approval: the buyer needs to demonstrate its need for IPv4 addresses to the RIR.

- Negotiate and contract: the buyer and seller need to negotiate and execute an agreement. This is true whether the transfer is made through an auction or a private sale.

- Initiate transfer: the seller starts the process at their RIR and pays any process fee. The RIR will contact the destination RIR if the addresses are going to another region.

- Justification checked: the source RIR checks the buyer’s needs assessment if this was not already communicated.

- Completion: buyer and seller gives approval. The RIRs update their databases.

Achieving RIR Compliance

Conducting due diligence of the intangible assets transferred during M&A can help organizations mitigate compliance risks and avoid legal issues and financial setbacks. It’s important to understand the compliance requirements of intra- and inter-RIR transfers, and how best to prepare for these with an M&A either in the past or on the horizon.

Whether you’re looking to start an intra- or inter-RIR transfer of IP address blocks, IPv4.Global can help ensure your company remains compliant throughout the process so you can sell these addresses smoothly and quickly. As a trusted broker in the IPv4 market space, our team operates across all RIRs and fully understands the complexities of IP address block transfers, regardless of geographic region.