IPv4 Market and IPv6 Deployment

November 10, 2020

IPv4.Global’s Lee Howard will be a panelist at the Internet Governance Forum’s session, “IGF 2020 WS #327 Believe it or not, the Internet Protocol is on Sale!” Preparing for this session has provided an opportunity to research how the IPv4 address market has affected the deployment of IPv6. To begin, we look at the total addresses transferred and the number of addresses transferred over time.

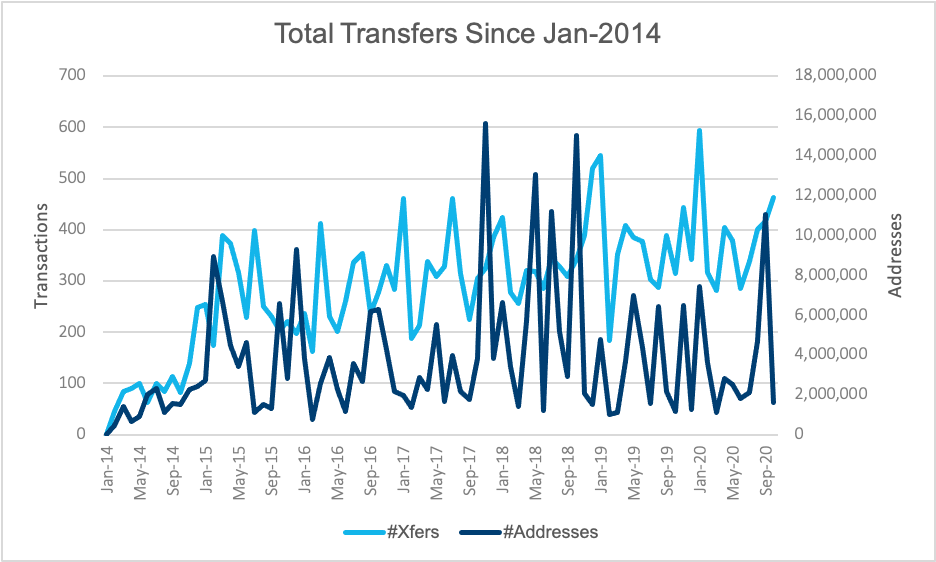

Chart outlining total transfers since January 2014.

There are a few spikes where a large number of addresses was transferred in a single transaction, most recently from APIDT.org. More broadly, the number of transfers has been slowly increasing over time, though there’s no corresponding trend in the number of addresses. In other words, there are ever more transfers of smaller blocks, a strength of the IPv4.Global online marketplace.

A few organizations have dominated this market.

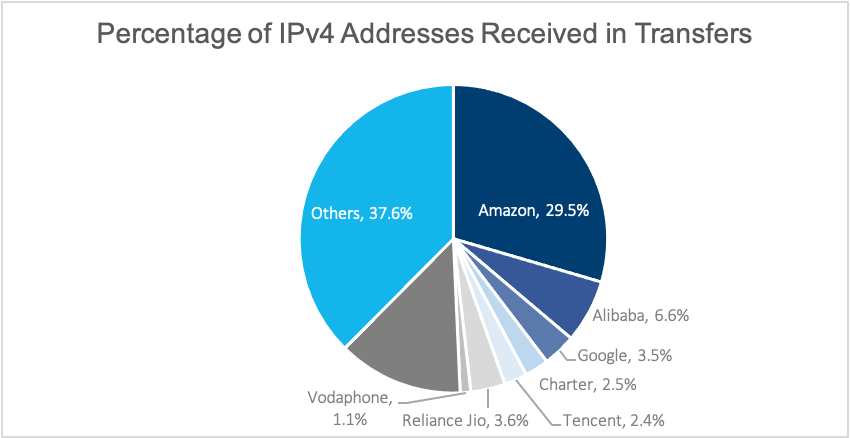

Pie chart noting IPv4 addresses received in transfers.

Cloud providers continue to dominate the market, roughly in proportion to their market share. A few access providers are represented. There has long been speculation that the IPv4 market has slowed IPv6 deployment.

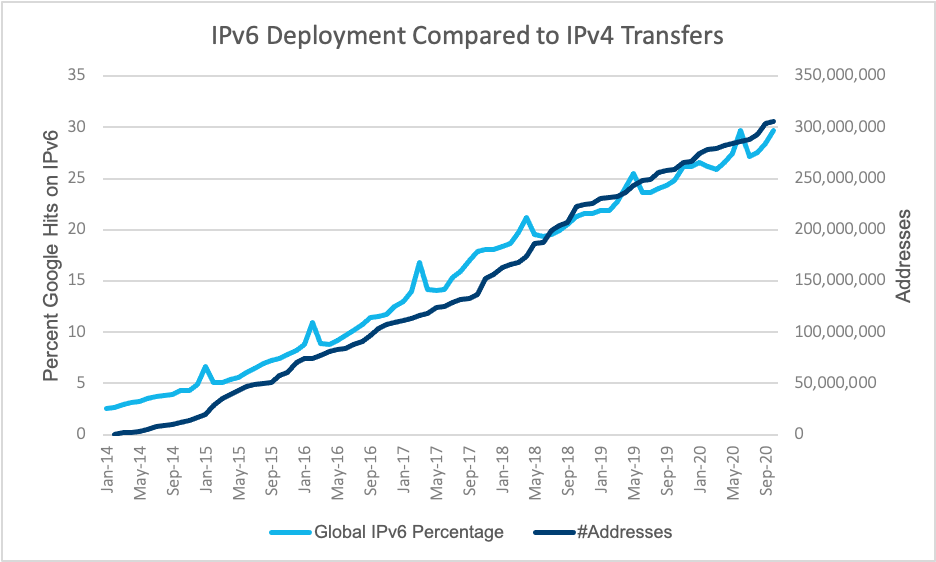

IPv4 vs IPv6 trend lines.

The “Global IPv6 Percentage” here is taken from Google’s IPv6 deployment statistics, which is widely cited though conservative. It reflects the percentage of his on Google sites using IPv6. There is an annual spike around December 23 – January 2, reflecting holidays where many more people are accessing Google sites from home: residential and mobile providers have much higher IPv6 deployment levels than enterprise IT departments.

The number of addresses is a cumulative total of the number of addresses transferred. The total accelerated in 2017 – 2018 as Charter Communications bought a lot of address space, and when they stopped, the IPv4 transfer growth returned to its previous linear rate.

The fact that these two lines are almost perfectly parallel suggests that the influence of one on the other is minimal: this is the Internet growth rate.

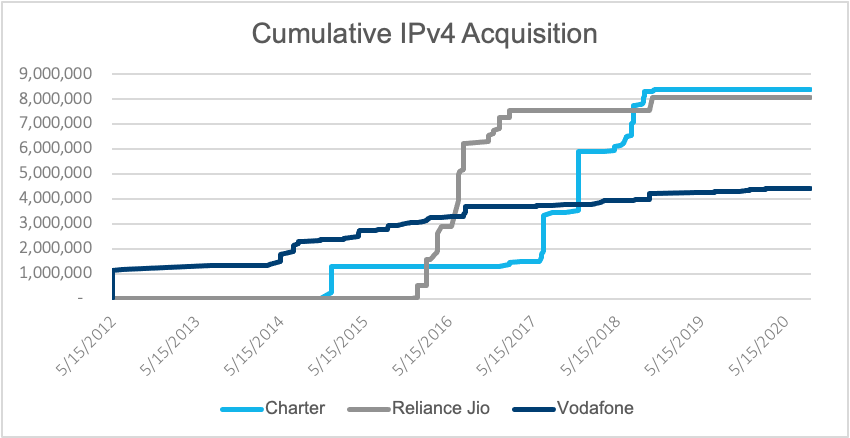

The acquisition by Charter is somewhat similar to the other two access providers among top buyers, although the three are very different companies. Charter is a cable TV and Internet company solely in the U.S. Vodafone may be unfairly grouped, but includes all Vodafone companies globally. Reliance Jio is an Indian mobile company.

IPv4 Acquisition information 2012 to today.

Reliance Jio came into the market like a rocket, which reflects the unique growth curve of their business, and then stopped. Charter made an initial investment, and then went on a two year binge, and stopped. Vodafone companies have been gradually accumulating, at their normal growth rate. IPv6 has seen increasing deployment over the same time period.

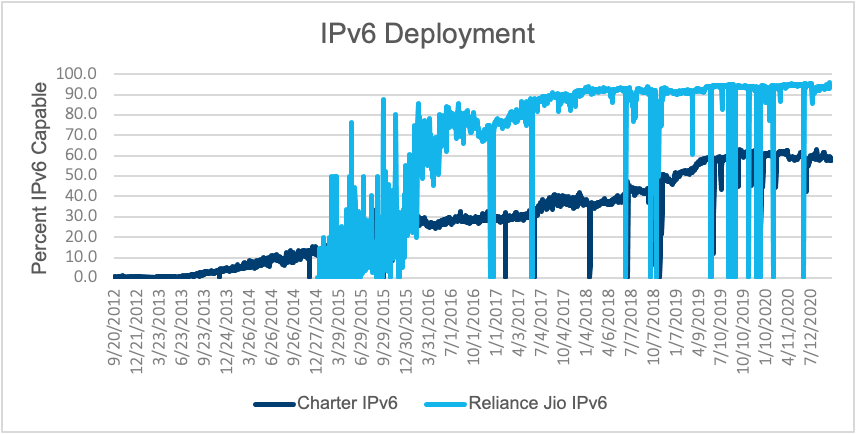

2012 to today, IPv6 deployment.

As with its meteoric acquisition of IPv4, Reliance Jio deployed IPv6 in a very short period of time, and nearly all devices on their network are IPv6 capable. Charter consists of multiple independent networks; averaging their IPv6 deployment shows a very gradual deployment rate, typical of churn rates. They did accelerate deployment in 2018-2019, shortly after their final IPv4 acquisitions.

There is no evidence that IPv4 purchases delay the deployment of IPv6.

IPv6 deployment among cloud providers is harder to measure, since they are hosting many different customers’ equipment. Just from researching their IPv6 capabilities, most services offered by Amazon Web Services are IPv6 capable, although Amazon.com and other web properties are not. Google Cloud Platform the reverse, where very few services are IPv6 capable, but most of their web properties are. Microsoft Azure is in the middle, with a few IPv6 cloud offerings, and a mix of IPv6 capability on their web properties. Within that small sample size, IPv4 purchase and IPv6 capability and size all correlate.

Based on this limited view, it would seem that IPv6 deployment and the purchase of IPv4 addresses are complementary responses to growth and scarcity. Companies that buy large amounts of IPv4 addresses also tend to deploy IPv6.

Most of the data above has been taken from the RIRs’ transfer logs, and excludes transfers known to be mergers and acquisitions. IPv6 ISP deployment is from APNIC’s measurements.

The Internet Governance Forum session, “IGF 2020 WS #327 Believe it or not, the Internet Protocol is on Sale!” is on Tuesday, November 10 at 1120 UTC. Attending the session is a free but multi-step process.