Diverging Prices

& Buyer Opportunity

by Peter Tobey

Summary: The price difference per IP address between large blocks (/16s) and somewhat smaller ones (/17s – /19s) is considerable. The $ per IP address differential is likely greater than the integration cost penalty of dealing with multiple small blocks. So, mid-size IPv4 address blocks offer a significant opportunity for buyers.

Pricing is primarily influenced by supply and demand. In the IP world, future value expectations, the costs of integration with existing systems, acquisition, and maintenance costs, etc. impact prices. These are projected and ongoing concerns, not those directly related to an immediate purchase. So, they are difficult to quantify and have variable effects on different buyers and sellers.

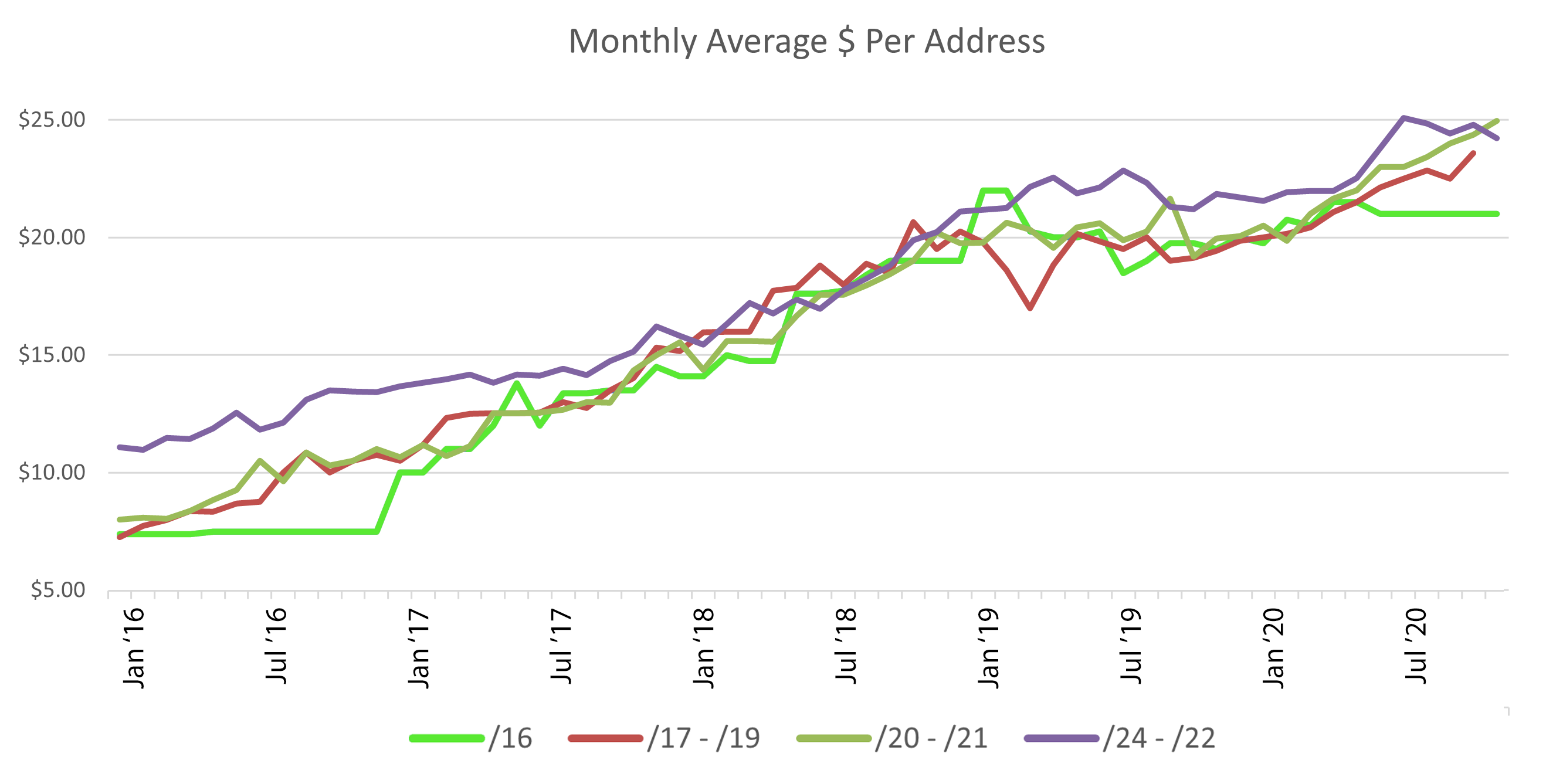

Still, for many years (2016 – 2020), larger IPv4 address blocks traded at something of a discount to smaller blocks. This discount wasn’t dramatic but was very consistent.

Large buyers promoted the idea that they should get a bulk discount for committing to a large purchase. Sellers of large blocks, often looking at a windfall, simply accepted the best (somewhat lower) offer. For the first years of the market, sellers had little opportunity to sell smaller blocks—there was essentially no small block market, and no pricing transparency until IPv4.Global began publishing its anonymous transaction statistics.

IPv4 Block Price Divergence

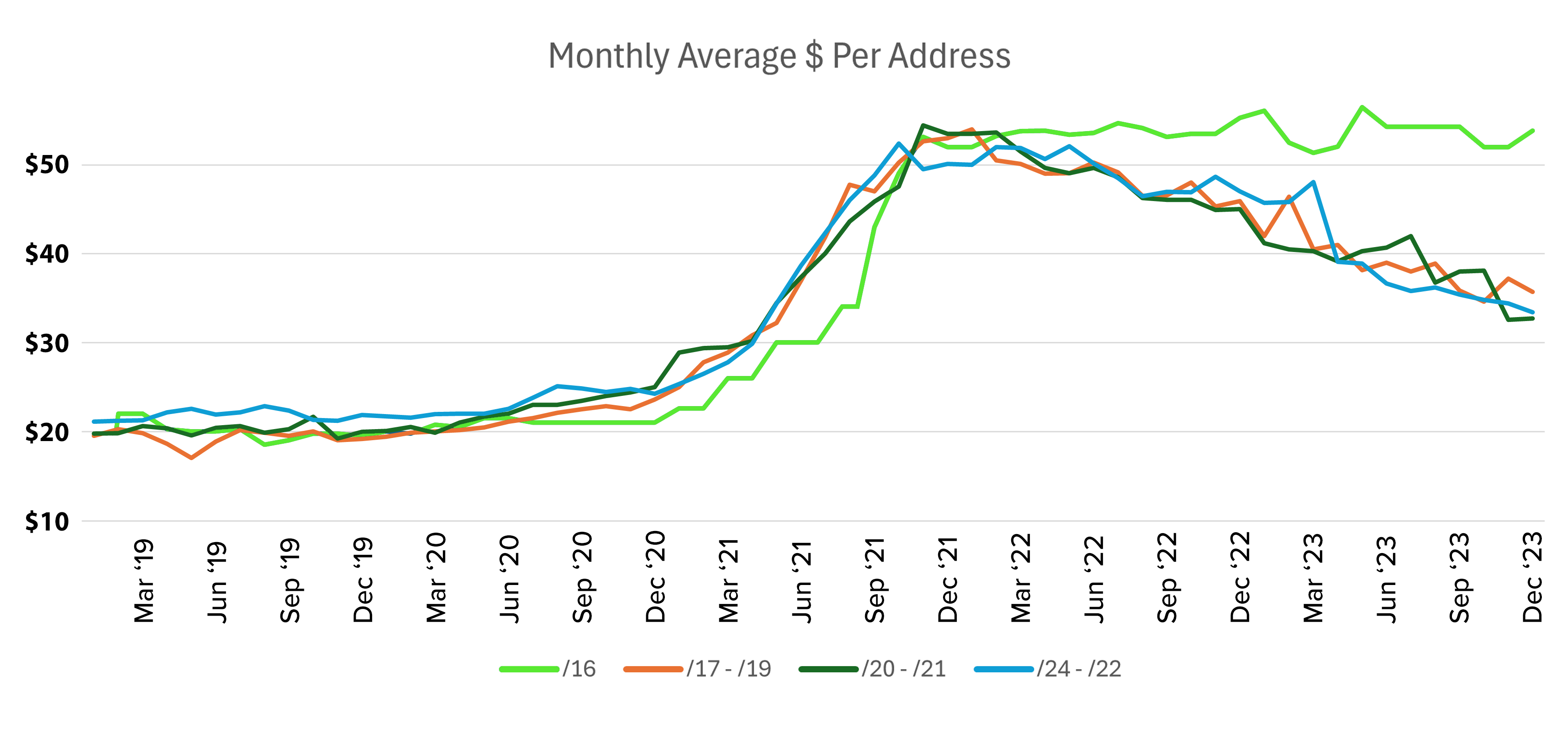

As you can see above, the lower per-IP price of large-block IPv4 addresses ended in late 2021. Large blocks became (relatively) more costly than smaller ones but continued to trade in a tight range. Smaller blocks began to be traded in a wider – and generally lower – range.

Today, sellers can expect a higher price-per-address for larger blocks. This makes sense in terms of scarcity: since every block of 65,536 addresses can be broker into (e.g.) four blocks of 16,384, we know there are more /18s than /16s.

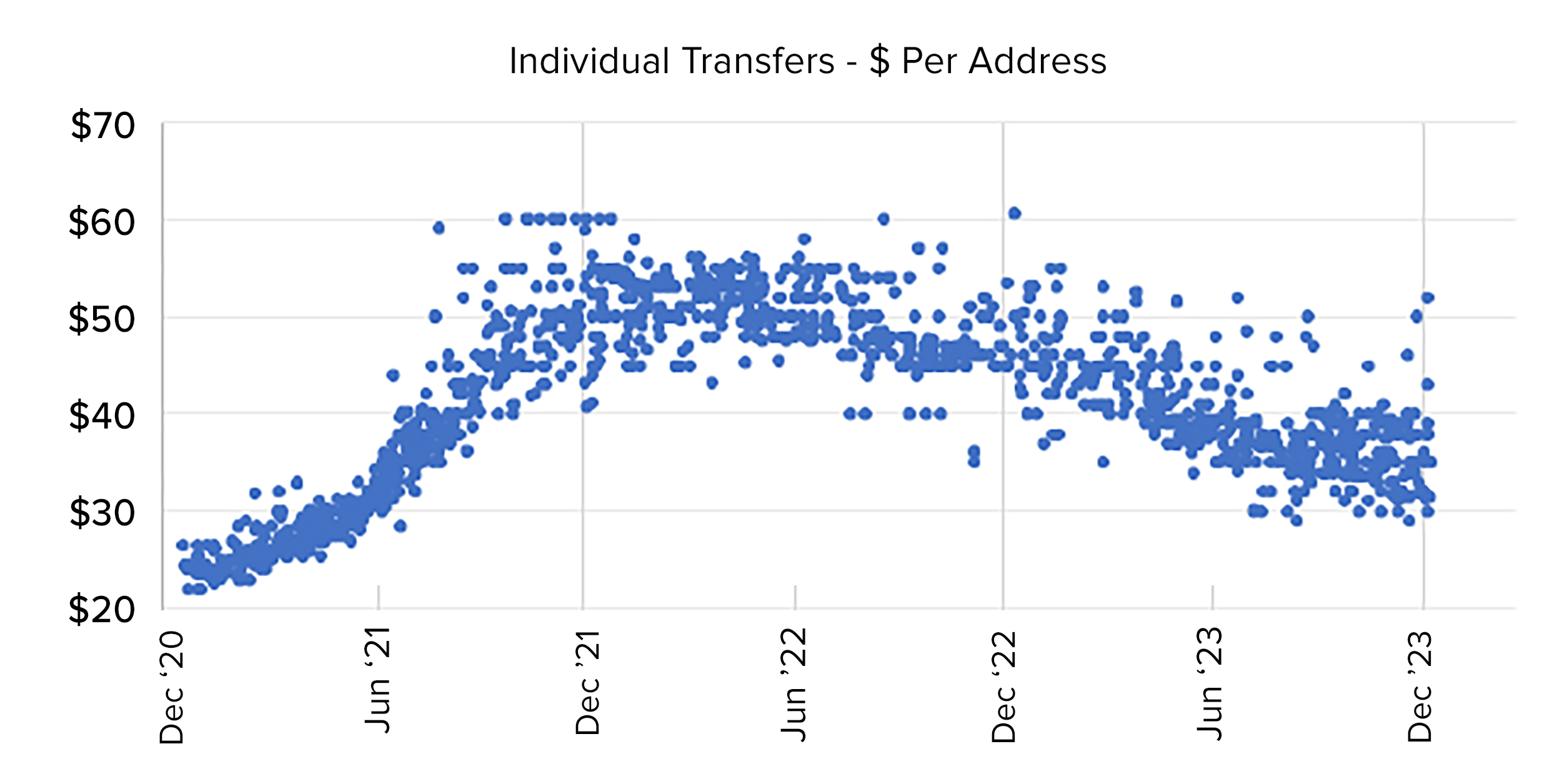

The above chart illustrates an associated-but-different phenomena mentioned above: prices have not simply diverged, separating large block prices from all others, they’ve scattered. Until late-2021, all IP addresses traded in a fairly narrow price range. There was some significant difference between large blocks and all others (large blocks commanding lower prices per IP address). But the per address price difference among all address block sizes was small and individual blocks within any given class traded very consistently.

The line graphs shown earlier depict this consistency well. However, since mid-2021 the scattering of prices among blocks in tight ranges is clear only when a graphing of individual trades is shown as in the scatter plot above.

The 2021 and thereafter, the scattering of prices for smaller blocks has continued. That is, the variability of pricing even among recent transfers of the same block size can be quite different. Today, we regularly see small-block transactions varying from $30 to $40 per IP address in the same week.

Opportunity

When a commodity trades in a wide range of prices the attentive buyer is rewarded. Regular monitoring of blocks being offered can yield significant savings. Features such as IPv4.Global’s “Notify Me” application can actively monitor blocks for sale and alert buyers when certain (RIR and price) conditions are met.

Also, the divergence in pricing between /16s and /17s is an opportunity for buyers. Two /17s – in spite of somewhat higher deployment costs – can save significantly over a single /16.

| Addresses/Block | Total Addresses | Price/IP | Cost | |

| One /16 | 65,536 | 65,536 | $47 | $ 3,080,192 |

| Two /17s | 32,768 | 65,536 | $35 | $ 2,293,760 |

65,336 IPv4 addresses currently cost about 25% less when bought as two /17s. That’s a huge saving for the cost of two routes and two configuration lines instead of just one. As noted, there is a small increase in complexity when using multiple blocks in this way. (Some of them are discussed below.) But in most cases, that complexity is more than compensated for by the lower purchase price of the smaller blocks.

Complexity and Security

While you might want to get a single IPv4 prefix to meet all your needs, that is not always the best approach. Some organizations will want to separate their internal management functions from public facing functions. Some will simply be happy to buy only the addresses they need for their next growth period.

Managing multiple prefixes used to be more challenging than it is today. IP address management (IPAM) and configuration management weren’t widely used by IP networks in the 1990s. But we now have mature markets for both. This makes it much easier to design, implement, and monitor consistent policies through automation.

Deploying configuration management significantly reduces concerns about configuration complexity. It also makes it easy to audit and update configurations quickly and predictably.

Flexibility

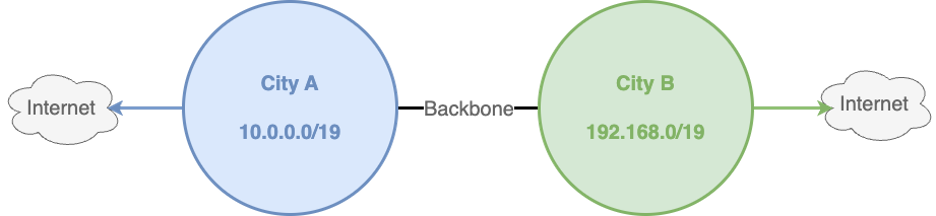

If your organization wants to route parts of its network in different ways, having multiple prefixes could be an advantage. Not all networks are based in one location, with one set of connections to the internet.

If your network has multiple sites, or multiple uplinks, having multiple prefixes could be ideal. For instance, a network with sites in two cities might want to keep each city’s traffic local. One way to do that is to use a different prefix for each site.

Example of an organization with one IPv4 prefix per site

It is possible to organize routing so most traffic for each site will arrive through the local link. It is also possible to organize routing so the other site provides a backup connection. This means neither site will be disconnected when its uplink is down for maintenance or an unscheduled interruption.

Trends

Predicting future prices is a perilous undertaking and not one that is happening in this blog. There are a considerable number of influences on market pricing of IPv4 addresses and many of them are unpredictable. However, the most recent, short-term trends in both large and all other block prices seems to suggest some convergence in prices. Even if the difference in prices among these blocks remains as it is or becomes slowly lessened, the price spread among these assets’ prices are significant.