January 2026 IPv4 Marketplace Sales Report

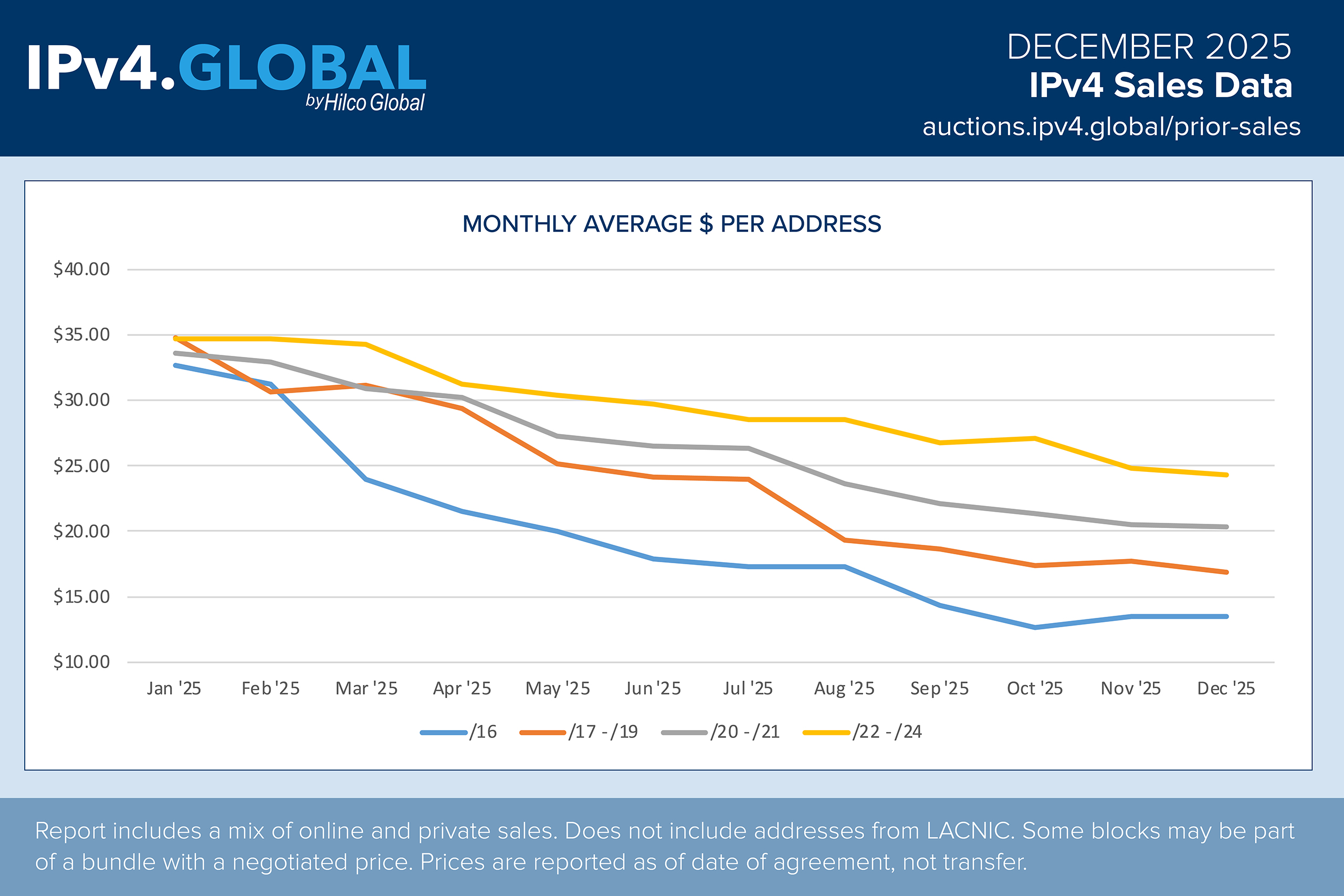

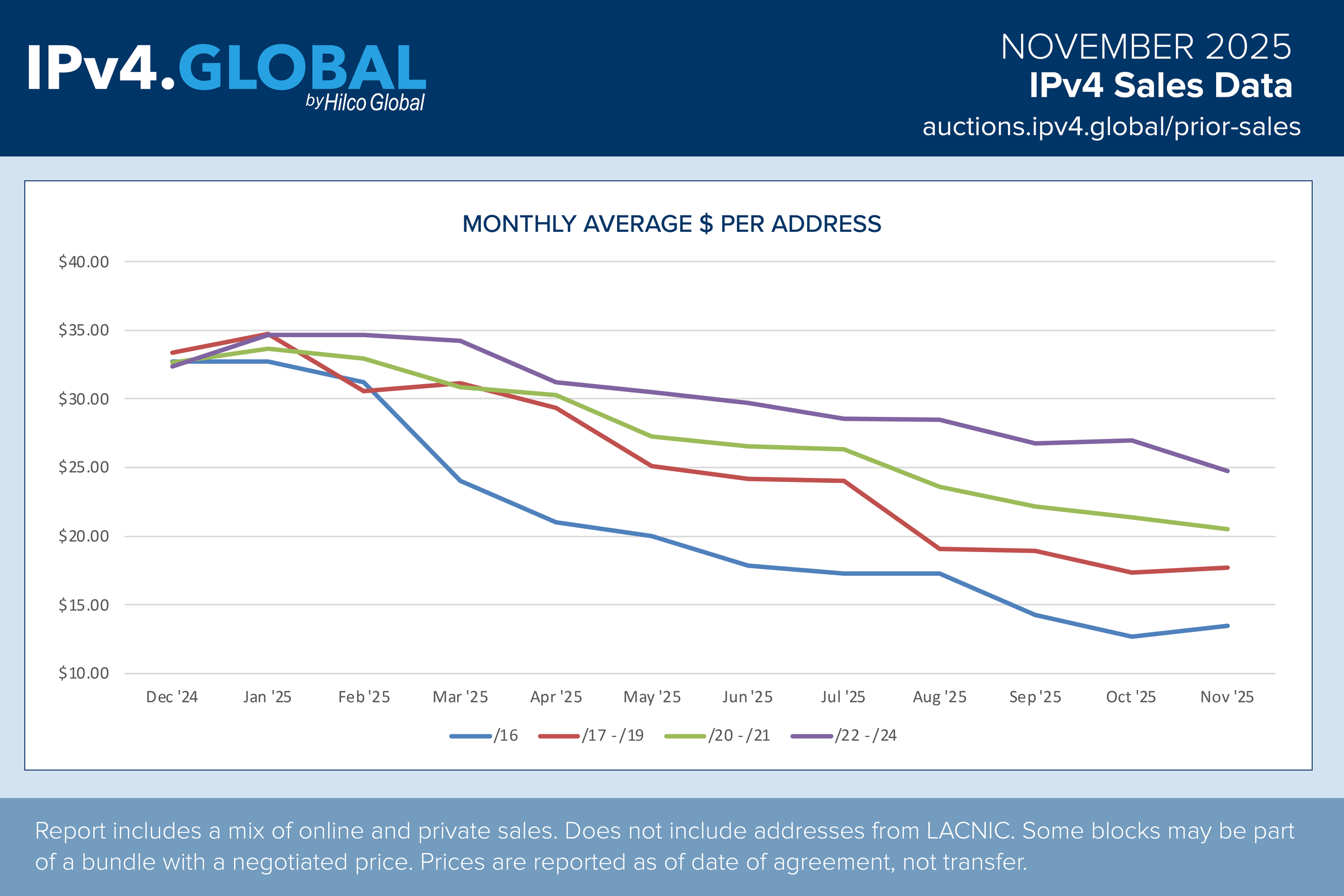

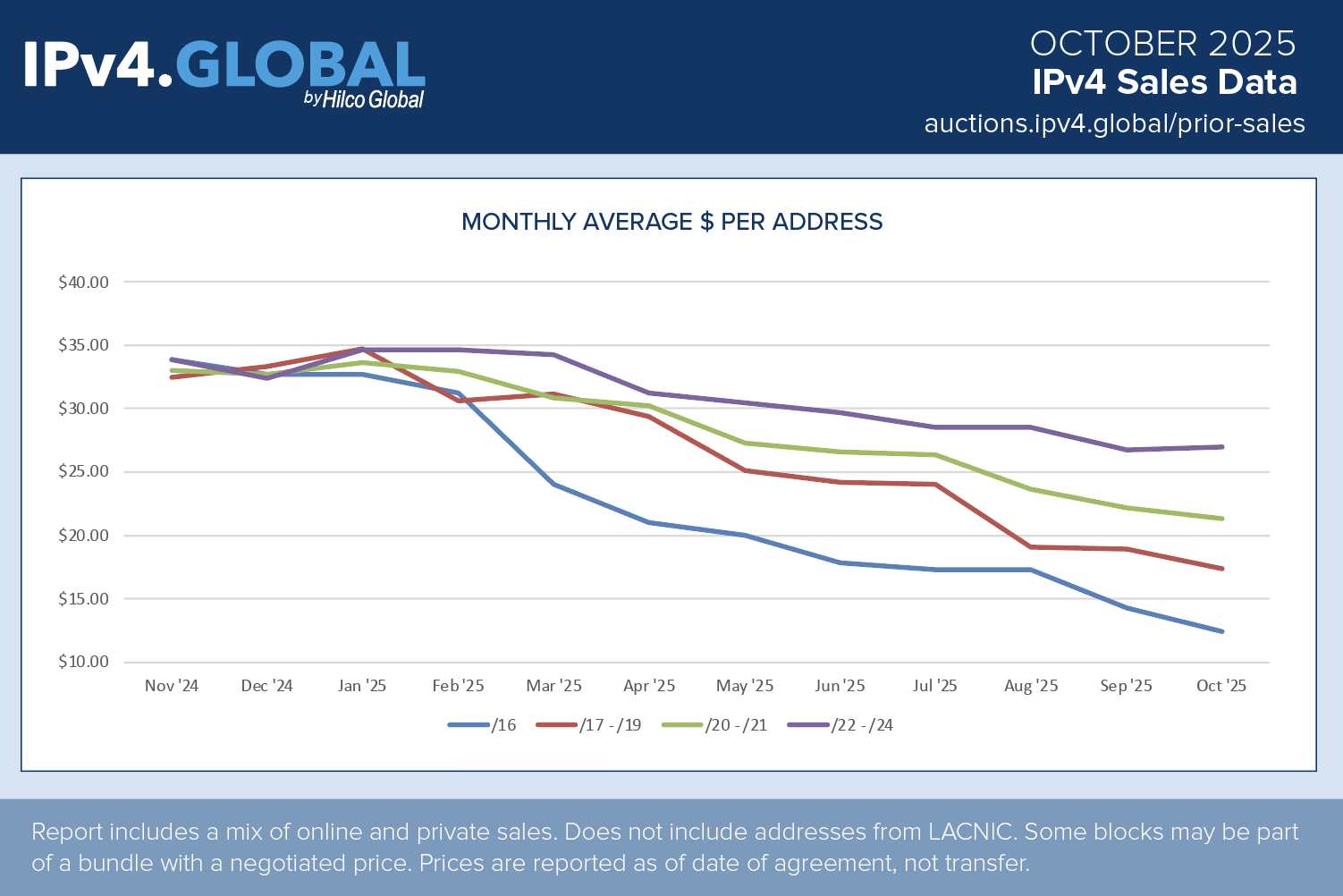

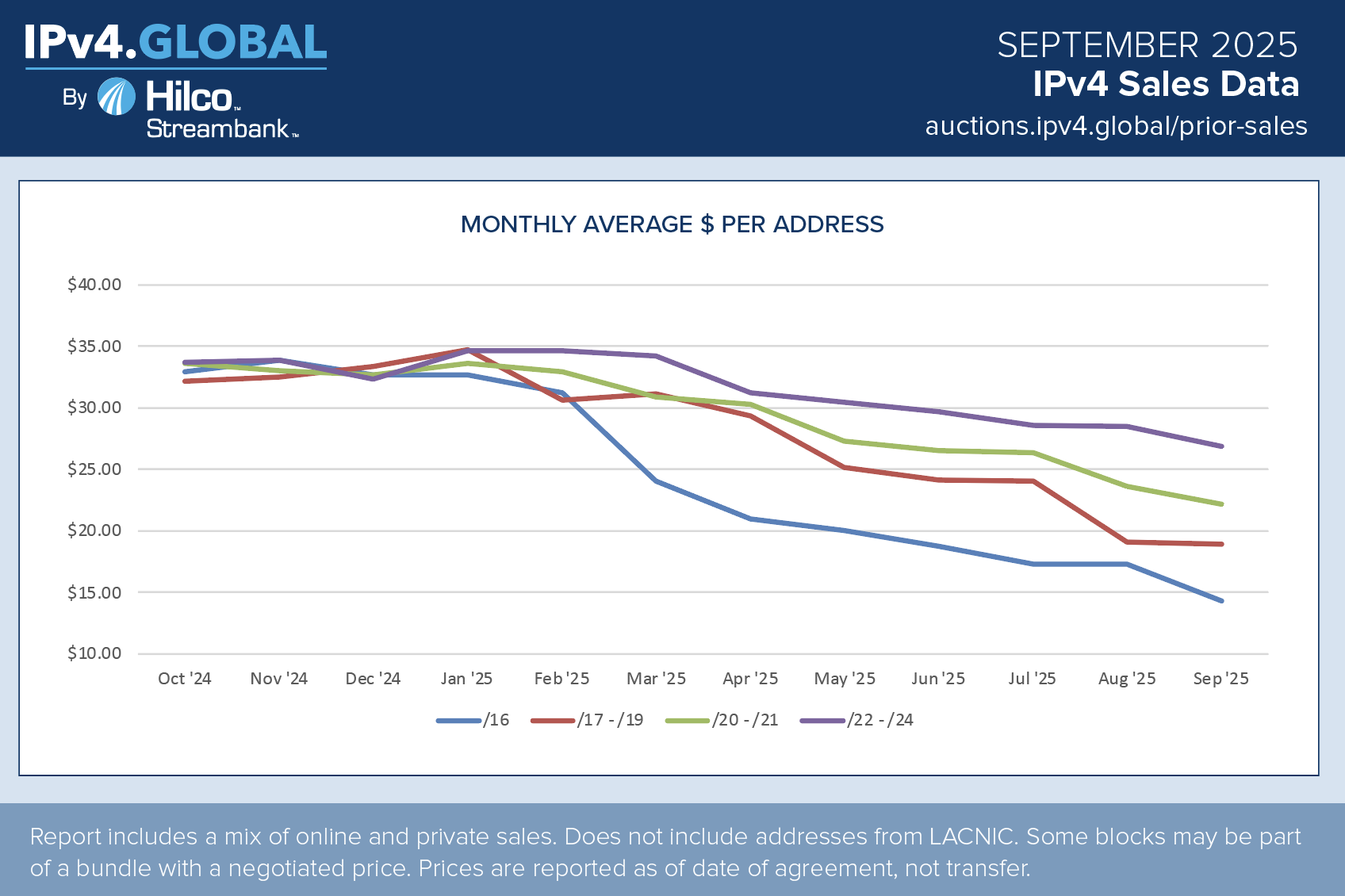

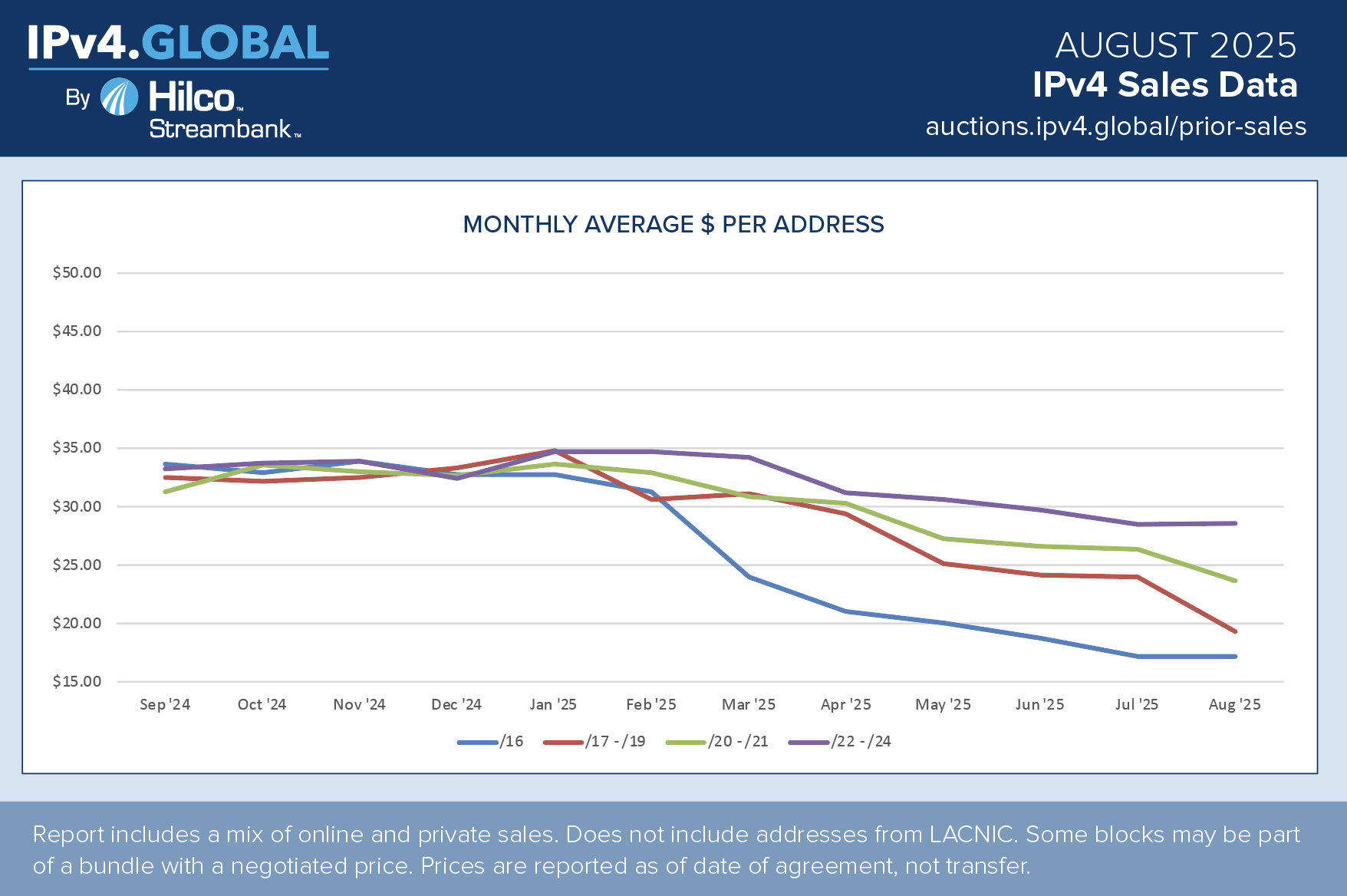

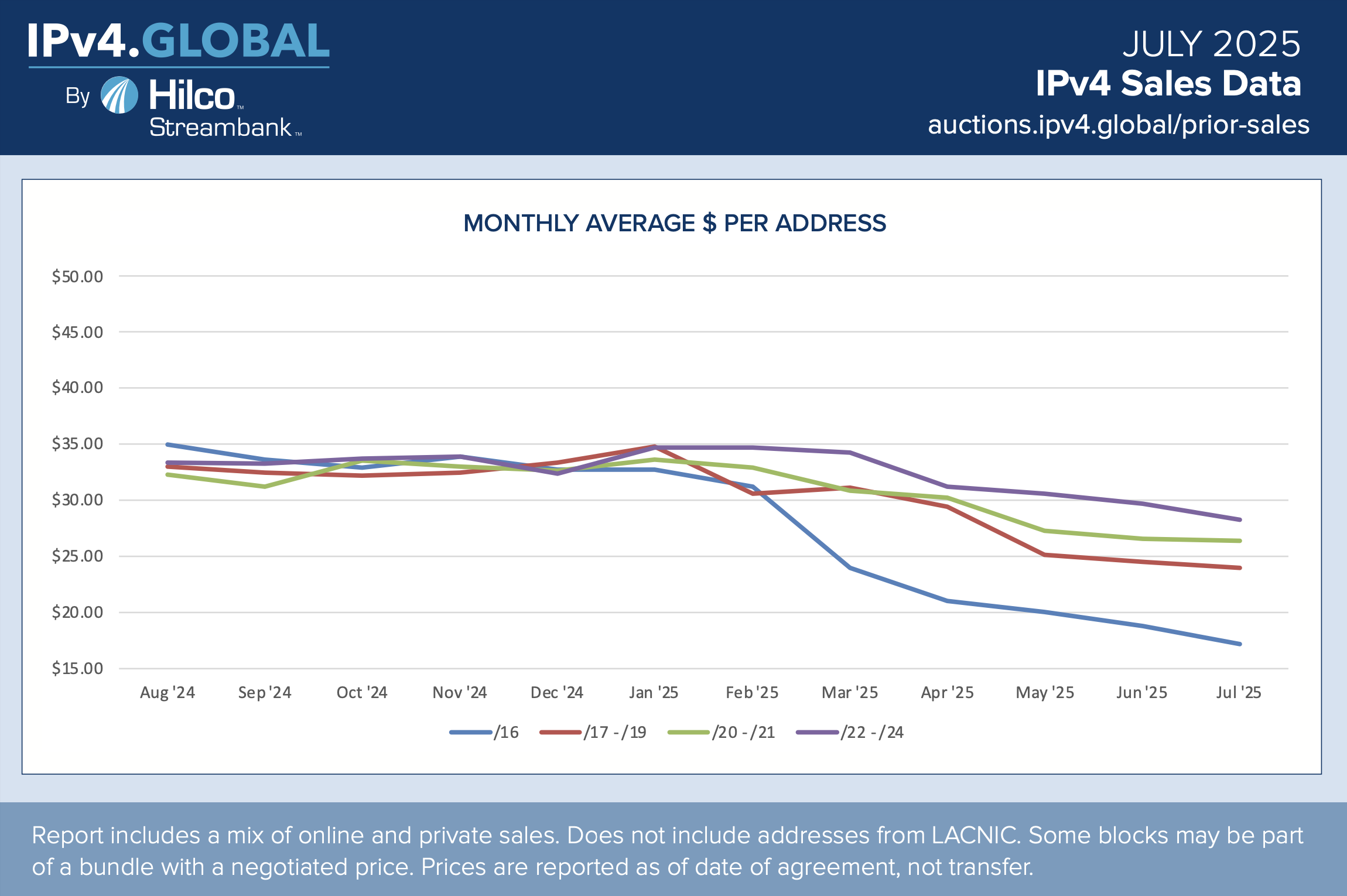

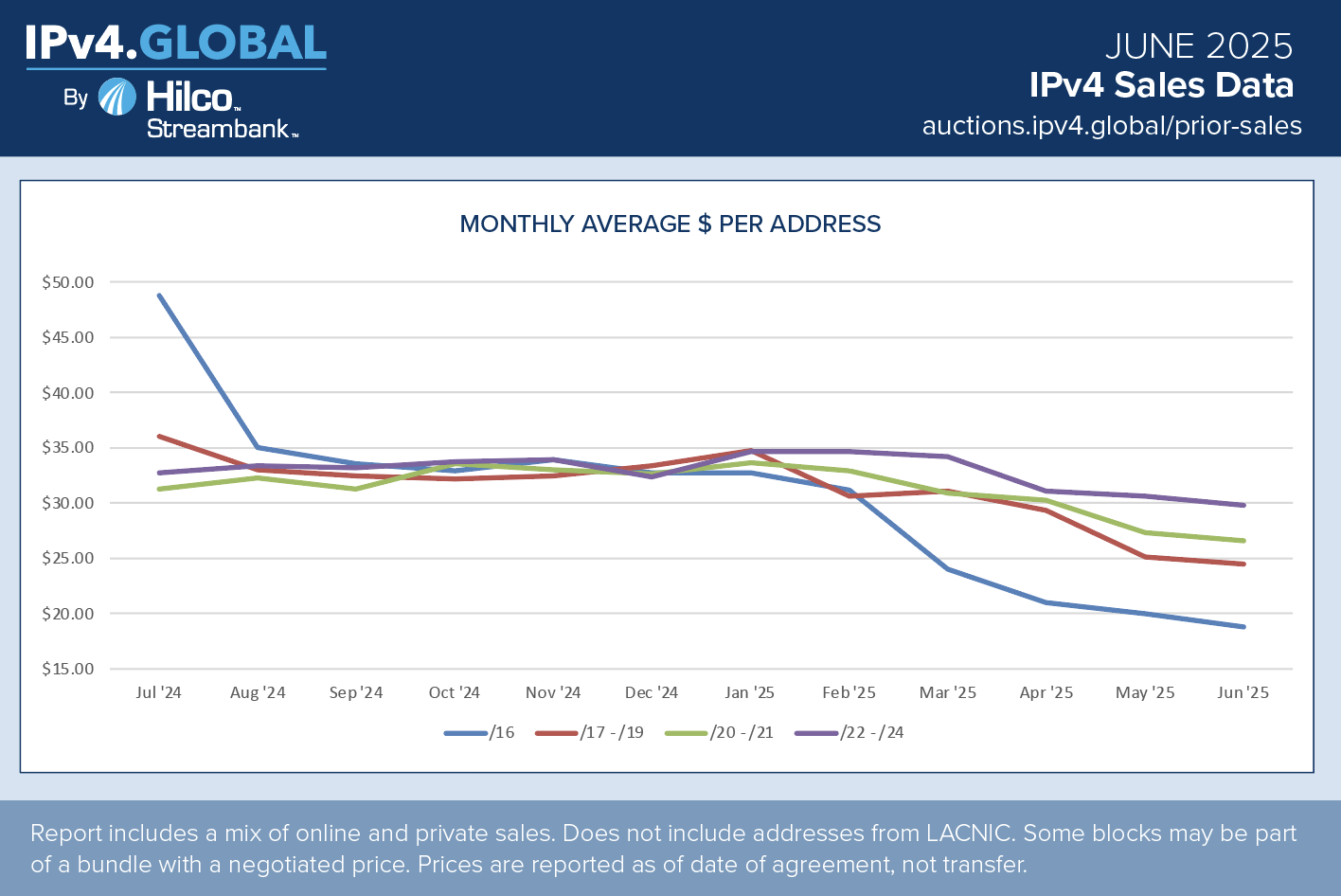

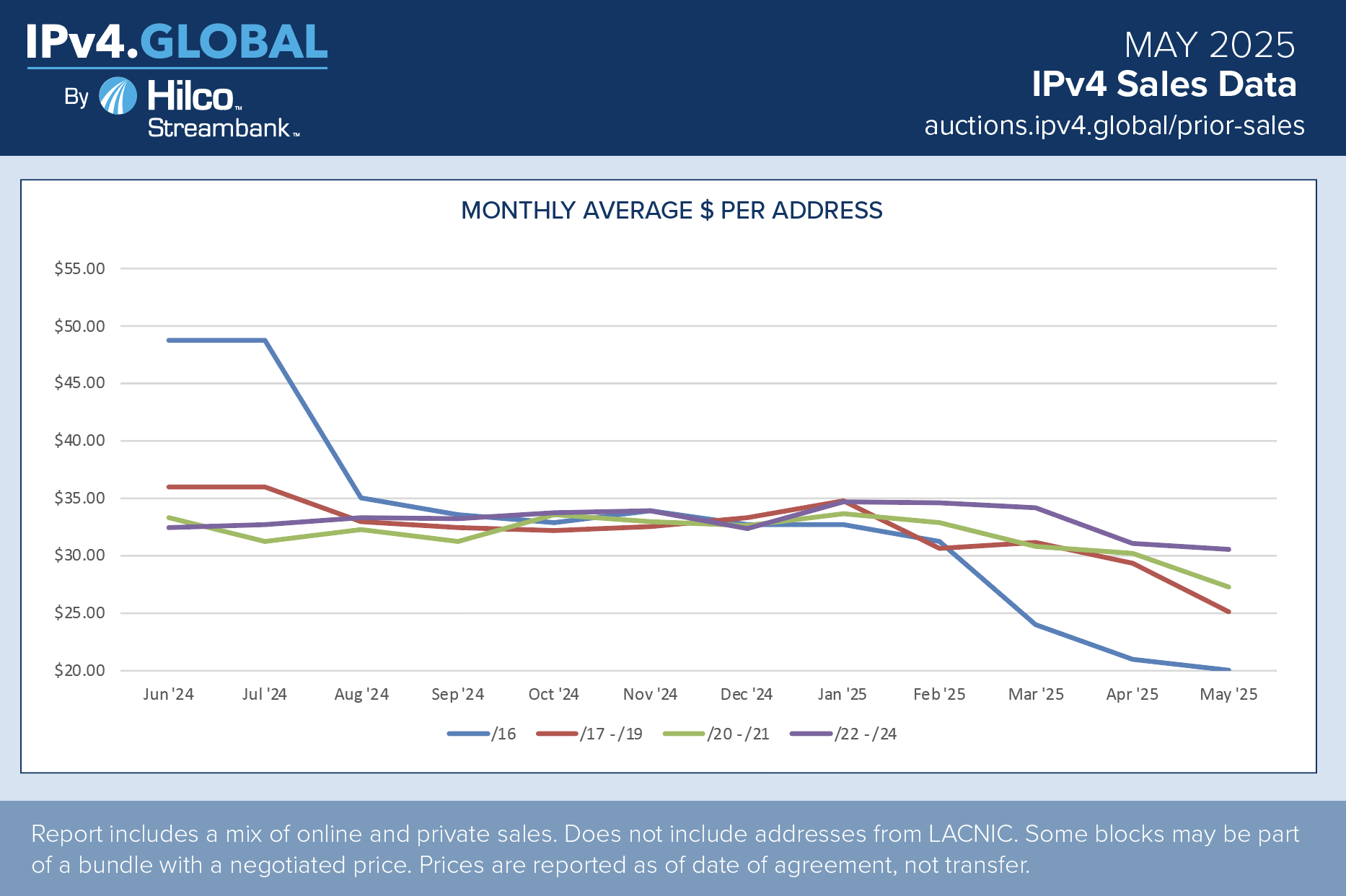

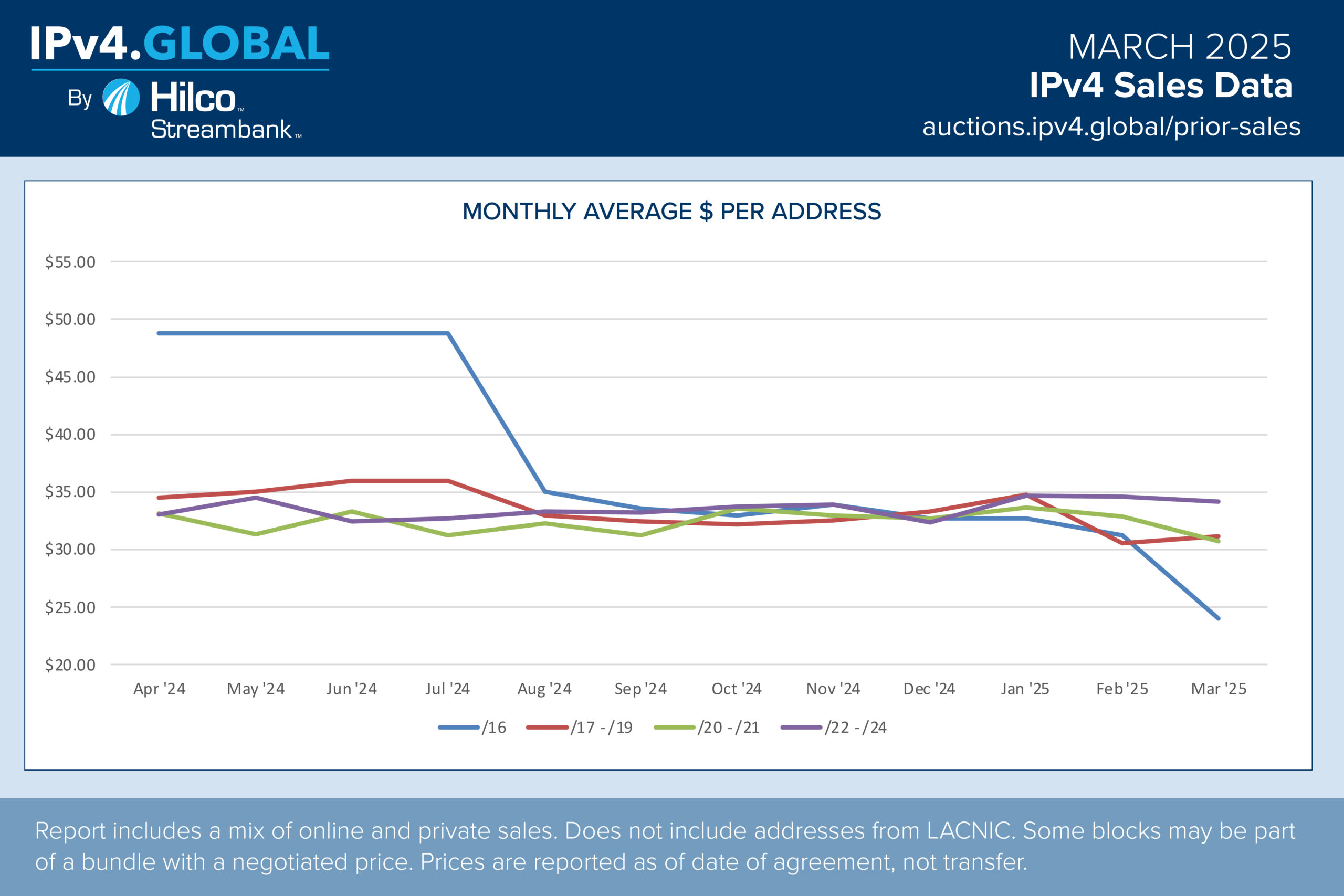

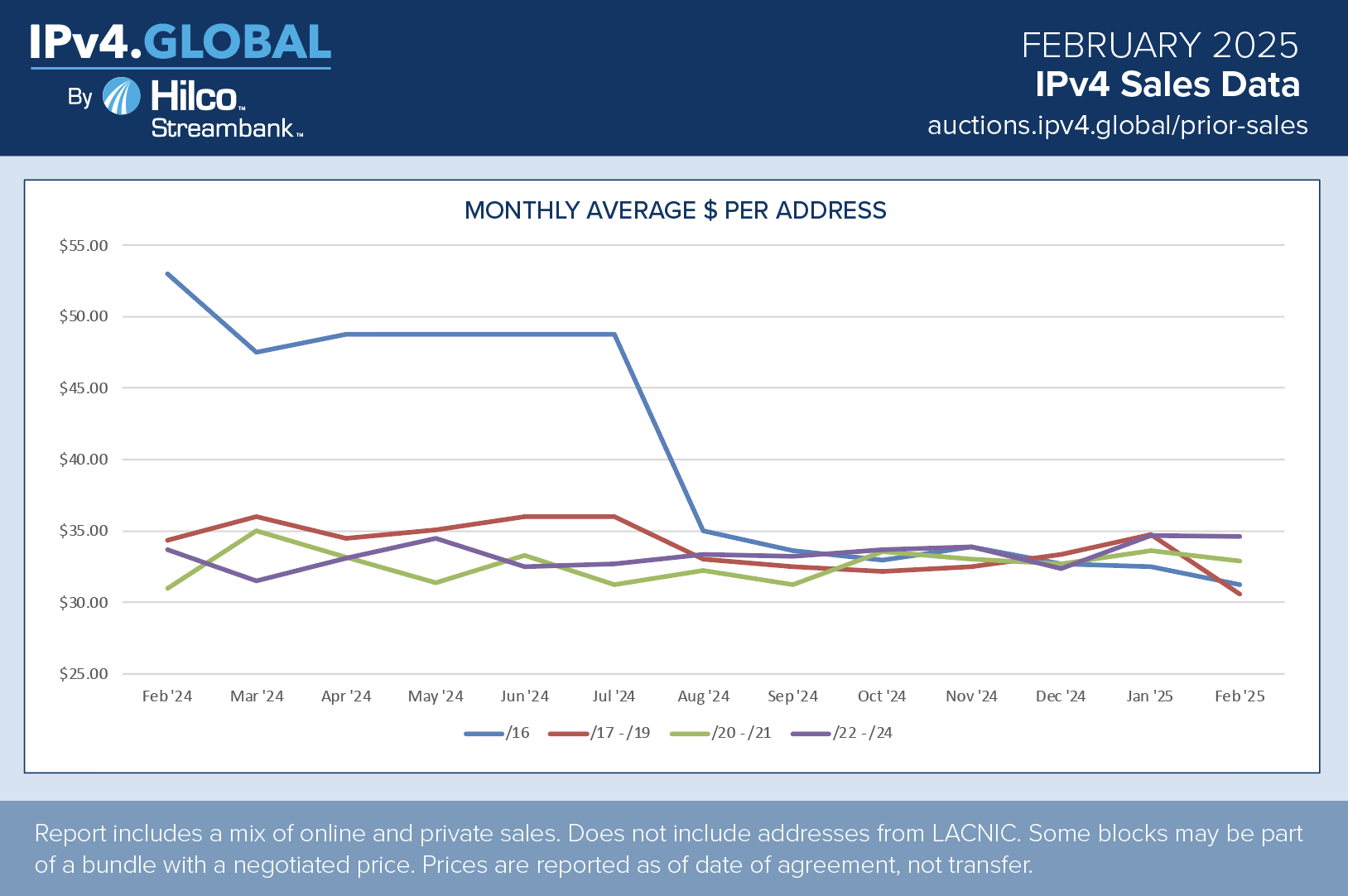

January 2026 opened with continued momentum in the IPv4 transfer market, with transaction volume reaching new highs and a notable influx of new buyers entering the space. Despite increased demand, average prices continued to trend downward, though lower /16+ pricing reflects larger package sales completed at discounted rates.

Read more